Contact information.

-

Address"Ekzarh Yosif" street, 31, 1000 Sofia, Bulgaria

-

Phone:+359 2 980 95 99

-

Websitewww.balkanservices.com

Companies are starting to take the ESG topic more seriously, and more will show how this approach can also drive value creation. In this article, our partners at Lucanet explain why it’s up to CFOs to link ESG strategies and actions to specific drivers of financial value creation.

We will discuss the importance of choosing the right ESG KPIs for your company and how they can be linked to financial value drivers that shareholders would expect to see acceptable returns from.

The number of ESG metrics that need to be reported depends on the topics and issues that are assessed as material to your company. This often results in reducing the list from over 1,100 to a few hundred, which is also challenging

Choosing the right ESG-related key performance indicators (KPIs) is not much different from choosing the right financial metrics. The main difference is that many ESG metrics do not follow a mathematical formula.

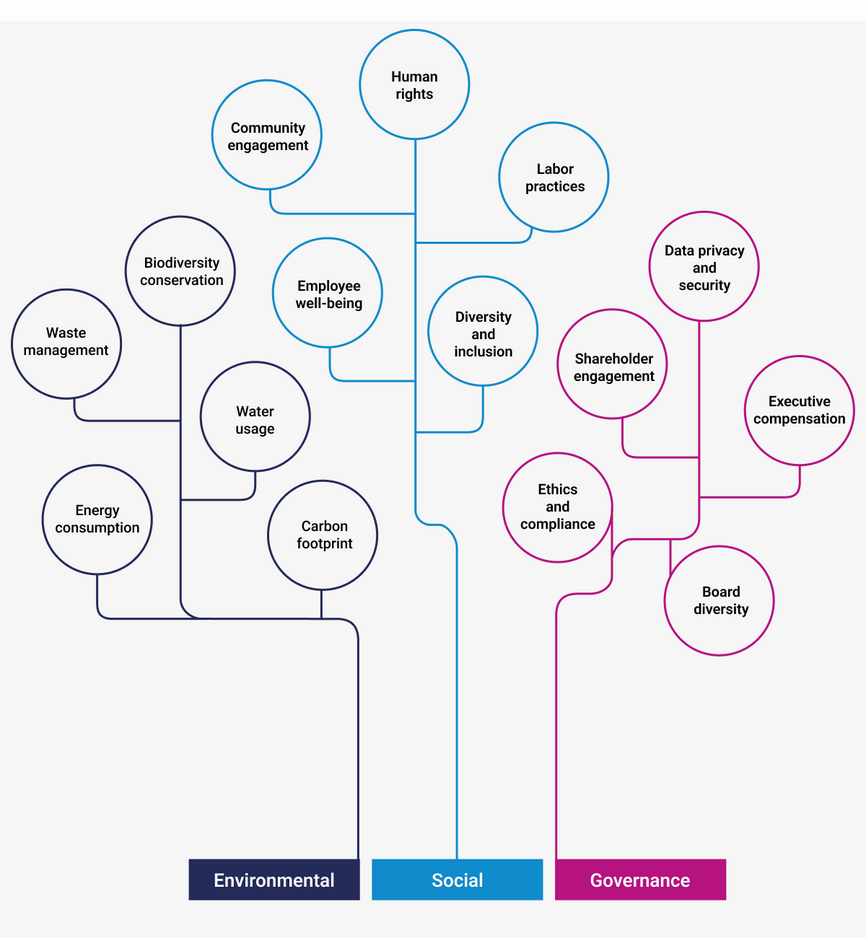

For simplicity, our partners at Lucanet interpret them as a “value drivers tree.”

For example:

In the example presented, the Environment, Social, and Governance divisions are distinguished, but they can also be further subdivided into sub-categories according to business needs. This will enable you to create a more comprehensive and detailed “value drivers tree.”

Another challenge is creating comparable metrics that will allow you to consolidate results.

We share 4 steps to simplify this process:

This will allow you to calculate a comparable score at each level of the “driving force tree” and calculate the overall ESG score.

It will not be comparable to other companies as there is no set standard for this.

This doesn’t remove the common challenge of finding ways to account for all of these metrics but supports you in creating a relevant approach to work with. By doing so, you make a tool that you can use to measure your results and have data-driven discussions about how to improve them.

Read more: ESG reporting in practice – examples and new aspects

According to LucaNet, this is perhaps the most difficult task for finance professionals because it is challenging to translate ESG metrics (or non-financial metrics) into financial values.

It is possible, and we share a few illustrative examples from our partners:

Not all metrics are as easy to quantify financially, but similar processes can still be created to measure economic impact.

Read more: What is ESG software?

Unfortunately, there is no single answer. LucaNet advises that a thorough analysis of the principle of the dual materiality of your business on ESG components and, at the same time, how they impact it should be done.

It is likely that you will also need to seek assistance from external ESG consultants.

Our team is here to listen carefully and offer the right solution for you.

This is a process that each company must follow with potentially different outcomes and therefore there is no single correct list of ESG metrics for all organisations. It is likely that once you go through the first stage of defining metrics and start measuring the selected KPI’s, you will find reasons to change.

According to a survey done by our partners at Lucanet, 50% of the time, finance departments are responsible for ESG reporting.

What is your approach to choosing the correct key metrics for ESG reporting if you have started the process?

If not, don’t worry because you’re not alone. Many companies are still navigating the regulations and will be trying out different approaches to creating value using ESG metrics.

If you need support in the sustainability reporting process, don’t hesitate to contact us.

*Source:The blog of our partner Lucanet